Articles de la rubrique "Bookkeeping"

Accounting Ratios

Several types of accounting ratios can determine various types of information. The accounting ratio calculator is available for download in Excel format by following the link below. Leveraged Assets Contribution to NI is the percentage of the pretax income that is provided by management’s use of debt to fund assets.

Is there any other context you can provide?

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

What Are the Types of Ratio Analysis?

Accounting ratios are also used to spot and analyze companies in potential financial distress. These are just a few examples of the many accounting tools that corporations and analysts use to evaluate a company, however. Many other tools highlight different aspects of a company so you’ll want to explore and potentially use them as well. Liquid assets include cash and anything that can be easily converted to cash.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- It doesn’t involve one single metric; instead, it is a way of analyzing a variety of financial data about a company.

- The accounting ratio calculator can be used by any business to calculate the most important accounting ratios.

Understanding an Accounting Ratio

As with all accounting ratios, you can use the above calculation to compare it with a different period. The profitability of a business is reported in the Profit and Loss or Income Statement. It is easy to see how a business is performing and compare it to other periods.

Important Accounting Ratios and Formulas FAQs

Earnings not paid to shareholders are expected to be retained by the company and invested in further operations. The Dividend Yield shows how much a company pays out in dividends each year relative to its share price. In the absence of any capital gains, the dividend yield is the return on investment for a stock.

Liquidity ratios calculate a company’s indebtedness in regard to measuring the liquidity or ability to service short-term debt. Accounting ratios are calculated on a periodic basis, usually yearly or quarterly, to analyze a company’s cash flow and financial situation. These scenarios require precise calculation of the gaining ratio to maintain partnership equity and ensure transparency in financial adjustments. The working capital turnover ratio is calculated by dividing the cost of sales by the net working capital. The dividend payout ratio is calculated by dividing $100,000 by $400,000, which works out to 25%, if dividends are $100,000 and income is $400,000. The higher the dividend payout ratio, the higher the percentage of income a company pays out as dividends rather than reinvesting back into the company.

The dividend payout ratio is the percentage of net income paid out to investors through dividends. Both dividends and share repurchases are considered outlays of cash and can be found on the cash flow statement. Furthermore, financial ratios will be useful if they are benchmarked against something else, like past performance or another company. But, remember to make it apple to apple if you are benchmarking with other companies in term of company business and size. The turbotax review can be used by any business to calculate the most important accounting ratios. Use the Inventory Turnover Period in Days Calculator to calculate the inventory turnover period in days from your financial statements.

In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Pretax Income is a made up of two sources, income from assets funded by shareholders equity, and assets funded by borrowed debt. The Dividend Payout Ratio is the percentage of earnings that are paid out to shareholders.

Working Capital Turnover measures the depletion of working capital to the generation of sales over a given period. This provides some useful information as to how effectively a company is using its working capital to generate sales. Use the Asset turnover calculator above to calculate the asset turnover from your financial statements. Return on Common Equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested. The Current Ratio is used to test the company’s ability to pay its short term obligations. Below 1 means the company does not have sufficient incoming cash flow to meet its obligations over the coming year.

Catégorie: Bookkeeping | Tags:

The 4 Best Accounting Blogs to Find Free Expert Advice

This blog tends to skew on helping keep accountants and small businesses productive in their firms. Brought to you by the makers of the accounting software product, Sage, here’s a blog that has a bunch of helpful content for those running a firm. The website regularly conducts salary surveys and provides insight into the compensation criteria of top accounting firms. Plus, it has a job board where companies can connect with potential candidates. Though the blog offers guidance on building your business, many articles focus on the benefits of outsourcing your work. It’s a helpful site for teams transitioning to remote work environments or working with contractors.

Future Firm ®

Instead, each blog is short and punchy, but full of information that can help you run a more tax-efficient business. The Journal of Accountancy blog is updated regularly, and they also have a great podcast if you what condition makes the value of irr greater than 100% prefer to get your news, updates, and insights while you’re commuting or out for a run. Jason Staats is a chartered accountant with an insatiable appetite for the future. However, it will augment rather than replace accountants outright. Indeed, a recent report by the Institute of Management Accountants suggested that there is a shortage of skilled accountants right now.

Top Remote Accounting Freelancers: February 3, 2024

Whether you’re just getting your business off the ground or trying to keep up with the ever-changing industry landscape, Future Firm has something for everyone. AFWA is another well-known information blog on career strategies, professional development, accounting, and finance tips, focused on promoting the professional growth of women in all facets of accounting and finance. Whether you are a student, an accountant, or small business, Accounting Coach is your place. Launched in 2003, it contains explanations, quizzes, puzzles, Q&A, videos on various accounting, bookkeeping, managerial and financial topics. Read all about what the New York Times says about accounting and accountants.

Best Books for Accounting Firms Looking to Modernize

To grow, innovate, and become an exceptional accounting professional, you need to learn and develop your skills continuously. Looking for a community where you can discuss what’s going cloud accounting benefits on in the industry? Join an online community of peers where you can chat (and occasionally commiserate) about the accounting business. Host John Garrett believes that taking time to share personal interests helps us all perform better as professionals. Each episode features a different industry professional.🎧What’s Twyla’s “And”?

Sign up for the monthly accounting program newsletter to see what it’s all about. Yep, the blog is a bit more straight-laced and covers accounting concepts that’ll help any small business owner. You can also sign up for the newsletter at the bottom of the site. Written by fellow industry professionals, here are some of the best accounting blogs and vlogs to keep you up to date on the industry. The blog is stuffed full of templates and accounting workflows that can boost your practice efficiency, alongside top tips on marketing and general practice management. While the tone might not be for everybody, Going Concern takes its work seriously.

- In many ways, they have single-handedly dismantled the perception that accounting is dull thanks to its sharp, erudite, and occasionally snarky take on industry news.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- While it’s still available in hard copy, the magazine produces a lot of online content and blogs from CPAs, accountants, and financial professionals.

- What’s more, Staats also has a YouTube channel and a podcast, and he’s even dipping his toes in TikTok if you’re looking for some bite-sized accounting takes.

- This blog does have a focus on accounting concepts along with general accounting and finance news.

- Soul of Enterprise PodcastHosted by Ron Baker and Ed Kless, Soul of Enterprise champions wealth created by intellectual capital.

If you want to learn about how technologies, such as cloud, can help you transform your business accounting, this is the blog for you. Sign up for Ryan’s weekly newsletter to get his latest tech roundups and industry insights for accounting and finance professionals. Dancing AccountantNancy McClelland, CPA, MAFM, also known as “The Dancing Accountant,” is committed to helping small businesses navigate the world of accounting, bookkeeping, and tax-related topics. Her blog is dedicated to providing up-to-the-moment accounting tips and resources. If you’re a small business owner or an accountant, you need to stay on top of ever-changing developments within the space. The IRS blog, while occasionally a little dry, is full of the information you need to navigate the world of tax, making it an essential resource.

Thanks for subscribing to the FreshBooks Blog Newsletter.

It’s easy to navigate and has up-to-date information to what are decentralized organizations the complete guide help all accounting aficionados understand their craft better. TOA Global’s blog is an excellent resource for anyone interested in honing their business, financial, and investment knowledge. It provides comprehensive insights and up-to-date best practices so readers can stay informed on the latest topics and trends shaping the world of finance.

Catégorie: Bookkeeping | Tags:

Accounting Outsourcing: How to Hand off Your Financial Tasks With Recommendations Bench Accounting

You can choose Bench if your business has not entered the growth stage yet and it will take some time for your financials to change. When you scroll through their site you will not be able to find pricing information for their services but instead, you will be able to book a free consultation with them. Depending on the services you require, you will then be given a customized plan. This is their automated accounting feature and you can access all information through the real-time accounting dashboard. For each additional service that you choose like Payroll, tax, back office, and CFO advisory, you will have to pay an additional charge for each and each of them is priced differently.

If you are a VC-backed company, Pilot is a good choice for you as they provide financial support to such startups. You might also be eligible for discounts on their plans if you are a pre-revenue company. With the many integrations that Bookkeeper360 offers, you can also find many solutions for back-office processes like inventory control, managing invoices, payments, and lendings. If you are just starting and need someone to set up your payroll, Bookkeeper360 will help you. You can also integrate with payroll management software like Gusto and ADP so that your payroll and bookkeeping can be accessed from one place. If you have any questions, you can get in touch with your bookkeeper from Bench’s platform or their app and they generally reply in a day.

QuickBooks Support

We refine our procedures with these regulations and regularly check with industry professionals to offer the utmost security. As an addition, you get access to lower credit card transaction fees, pre-authorized debit transaction fees, and many other benefits. We weighted each category equally to calculate our star ratings, and we also considered our accounting expert’s opinion and advice when ranking our top brands.

Pay your team

Typically, CPAs and accounting firms consider outsourcing bookkeeping at several key junctures. So if you’re in need of a bookkeeper that’s dedicated to helping you and your business succeed, schedule a free bookkeeping consultation and learn if QuickBooks Live Bookkeeping is right for your business. Our team of skilled professionals is equipped to handle diverse bookkeeping needs, ensuring that you receive a service that’s not just cost-effective but also reliable and of the highest quality.

It also saves you the time that you would have wasted in correcting errors made by accountants. There are three plans that you can choose from but the Flex plan is a good choice for small businesses who already have a bank discounts account and are looking for an outsourced accounting service. If you encounter complexities in financial transactions that require specialized expertise, outsourcing offers access to skilled professionals with the requisite knowledge. You can also invest the time saved in high-margin revenue generation activities and focus your attention on advisory services. Outsource bookkeeping services to QX and work with offshore bookkeepers who act as a seamless extension of your in-house team. They are meticulous and work out of a highly secure environment, and with the latest bookkeeping tools to ensure they deliver high-quality work quickly.

Many accountants offer bookkeeping as part of their accounting services or are willing to get you caught up before tax season. But the catch is that a CPA will generally charge more per hour than a bookkeeper would. They’ll typically charge their hourly rate, which is higher than a bookkeeper’s, because of the hard work in getting accredited. For example, when you sign up with Bench, you’re paired with a team of professional bookkeepers who gather your data and turn it into tax-ready financial statements each month. Then, our platform lets you track your finances, download financial statements for your accountant, and message your bookkeeping team. A freelance bookkeeper or a firm will operate outside of your business—they’re not an employee.

Management Accounts

- At Outbooks, we value privacy and secrecy of information as highly as you do.

- With most outsourced accounting service providers, you will be assigned a dedicated bookkeeper.

- SmartBooks also helps businesses with payroll management and benefits management by integrating with other service providers like Gusto and ADP.

- We give you your time back, so you can build your business knowing your books will be accurate and you can use financial data to help you grow.

- For example, when you sign up with Bench, you’re paired with a team of professional bookkeepers who gather your data and turn it into tax-ready financial statements each month.

We’ll reconcile and categorize your transactions, give you monthly financial statements, and put you in direct touch with your new bookkeeper through our messaging app. Virtual accounting services on the other hand rely on accountants to keep their business going operation and maintenance expenses definition therefore they make sure they hire the best and most qualified accountants. This ensures that all your accounts are maintained perfectly with zero errors.

Not only does this ensure that your payroll gets recorded correctly, but also makes sure your disbursements happen on time and you follow all compliances like workers compensation and others. For example, SmartBooks lets you know that each of their accountants has more than ten years of experience. There are no standard plans mentioned on their site but they do have an option to request a quote where depending on your requirements, and the industry your business belongs to you can get a custom plan. Irrespective of the size of your business, you can utilize these services that can be customized the balance sheet depending on the needs of your business. If you are a small business with under a hundred transactions, the Basic plan might be ideal.

Catégorie: Bookkeeping | Tags:

Closing Entries Definition, Examples, and Recording

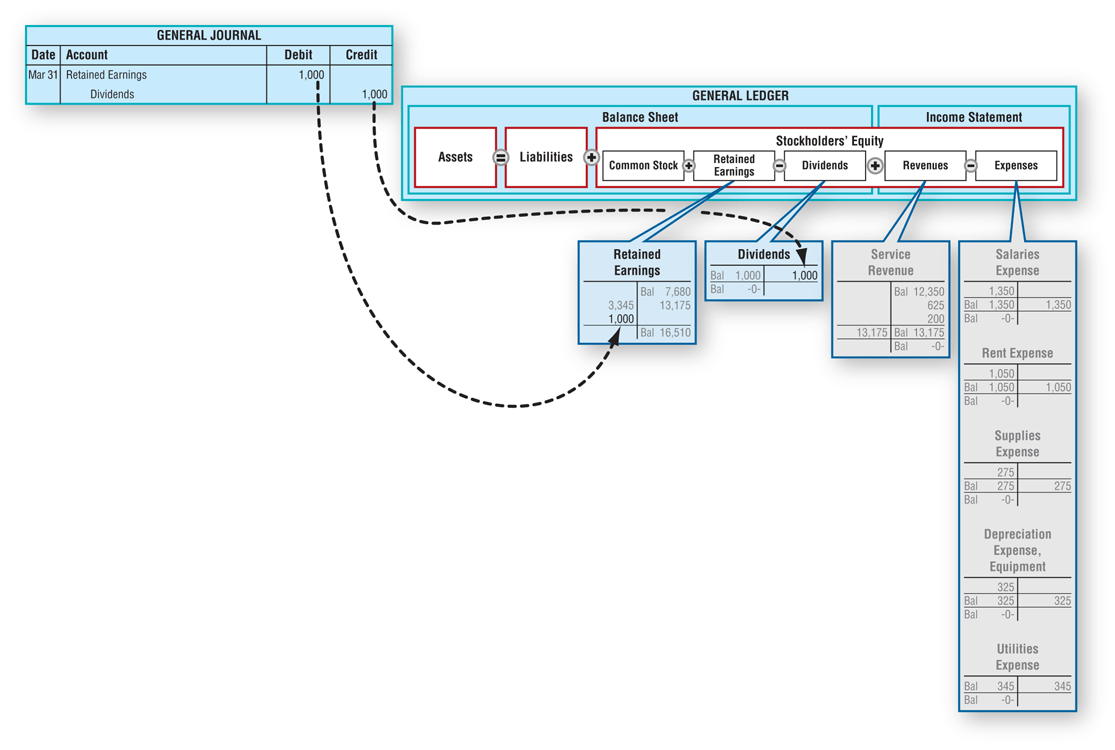

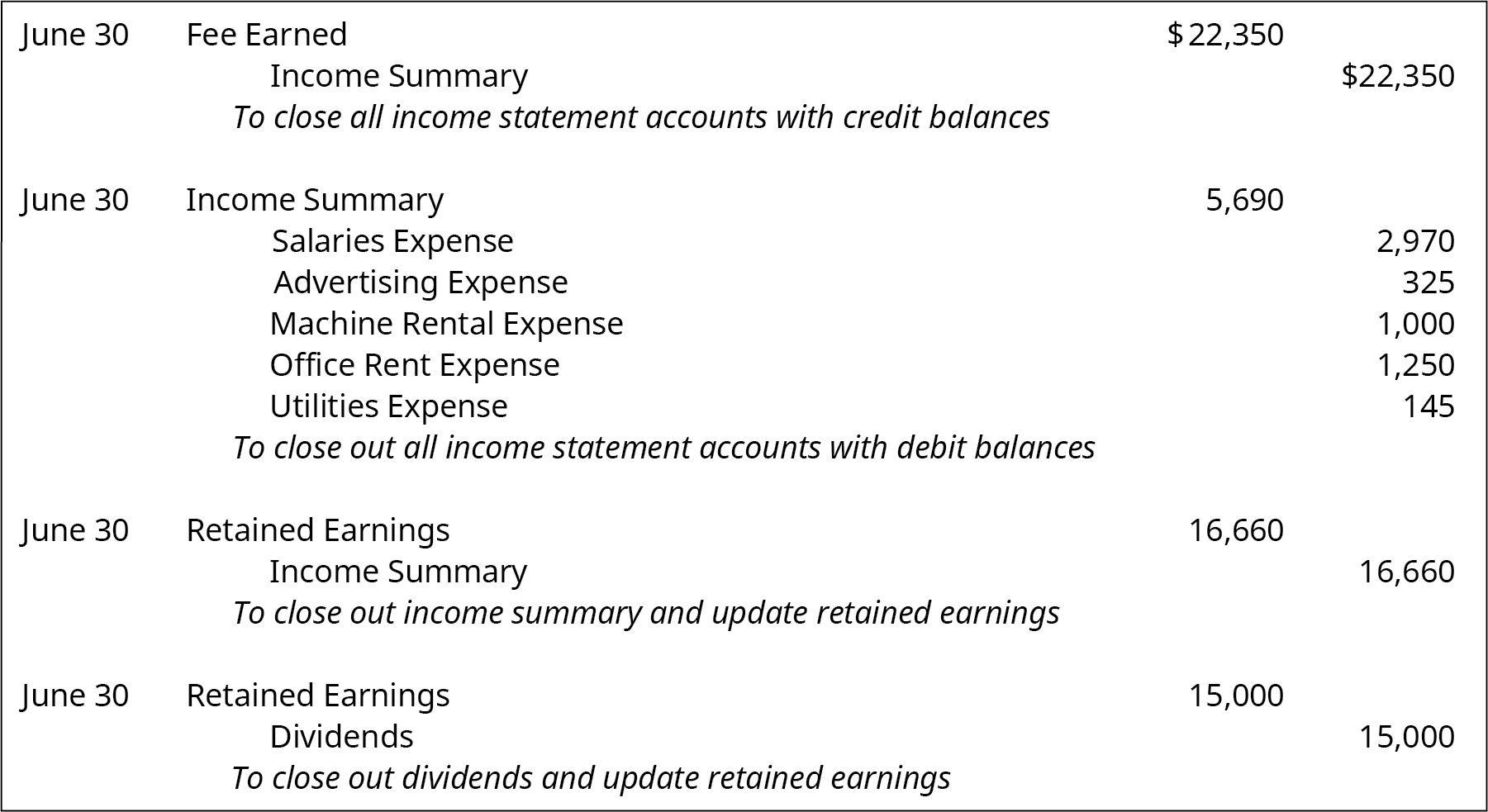

For our purposes, assume that we are closing the books at the end of each month unless otherwise noted. We at Deskera offer the best accounting software for small businesses today. Our program is specifically developed for you to easily set up your closing process and initiate book closing within seconds – no prior technical knowledge necessary. Now, the income summary account has a zero balance, whereas net income for the year ended appears as an increase (or credit) of $14,750.

Step 2: Close all expense accounts to Income Summary

These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings. To further clarify this concept, balances are closed to assureall revenues and expenses are recorded in the proper period andthen start over the following period. In summary, permanent accounts hold balances that persist from one period to another. In contrast, temporary accounts capture transactions and activities for a specific period and require resetting to zero with closing entries. Instead, the basic closing step is to access an option in the software to close the reporting period.

Reviewed by Subject Matter Experts

These accounts will not be set back to zero at the beginning of the next period; they will keep their balances. The accounts that need to start with a clean or $0 balance going into the next accounting period are revenue, income, and any dividends from January 2019. To determine the income (profit or loss) from the month of January, the store needs to close the income statement information from January 2019. The purpose of the closing entry is to reset temporary account balances to zero on the general ledger, the record-keeping system for a company’s financial data.

- Our program is specifically developed for you to easily set up your closing process and initiate book closing within seconds – no prior technical knowledge necessary.

- All expense accounts are then closed to the income summary account by crediting the expense accounts and debiting income summary.

- In summary, the accountant resets the temporary accounts to zero by transferring the balances to permanent accounts.

- Opening entries include revenue, expense, Depreciation etc., while closing entries include closing balance of revenue, liability, Depreciation etc.

Drawings Accounts and Closing Journals

Income summary is a holding account used to aggregate all income accounts except for dividend expenses. It’s not reported on any financial statements because it’s only used during the closing process and the account balance is zero at the end of the closing process. The net income (NI) is moved into retained earnings what is an accrued expense square business glossary on the balance sheet as part of the closing entry process. The assumption is that all income from the company in one year is held for future use. One such expense that’s determined at the end of the year is dividends. The last closing entry reduces the amount retained by the amount paid out to investors.

All expenses can be closed out by crediting the expense accounts and debiting the income summary. After this closing entry has been posted, each of these revenue accounts has a zero balance, whereas the Income Summary has a credit balance of $7,400. Permanent accounts track activities that extend beyond the current accounting period. They’re housed on the balance sheet, a section of financial statements that gives investors an indication of a company’s value including its assets and liabilities. Temporary accounts are income statement accounts that are used to track accounting activity during an accounting period. For example, the revenues account records the amount of revenues earned during an accounting period—not during the life of the company.

Part 2: Your Current Nest Egg

The balance in Income Summary is the same figure as what is reported on Printing Plus’s Income Statement. Both closing and opening entries record transactions, but there is a slight variation in their purpose. If dividends were not declared, closing entries would cease atthis point.

As the drawings account is a contra equity account and not an expense account, it is closed to the capital account and not the income summary or retained earnings account. The purpose of the income summary is to show the net income (revenue less expenses) of the business in more detail before it becomes part of the retained earnings account balance. After the closing journal entry, the balance on the dividend account is zero, and the retained earnings account has been reduced by 200. Why was income summary not used in the dividends closing entry?

All of Paul’s revenue or income accounts are debited and credited to the income summary account. This resets the income accounts to zero and prepares them for the next year. In essence, we are updating the capital balance and resetting all temporary account balances. When dividends are declared by corporations, they are usually recorded by debiting Dividends Payable and crediting Retained Earnings. Note that by doing this, it is already deducted from Retained Earnings (a capital account), hence will not require a closing entry.

Catégorie: Bookkeeping | Tags:

Florida Income Tax Rates for 2025

Florida’s lack of state income tax is a significant factor for individuals and businesses considering relocation, as it can lead to substantial savings compared to states with higher income tax rates. The federal income tax is a tax that the United States government levies on the annual earnings of individuals, corporations, trusts, and other legal entities. This tax is progressive, which means the tax rate you pay — the percentage of each additional dollar that goes to the government — increases as your income increases. For individuals, the income tax rates on ordinary income (as distinguished from capital gains) start at 10% and increase up to 37% as your income tax bracket increases. Understanding and calculating your tax burden in Florida is crucial for effective financial planning.

Federal Married (separate) Filer Tax Tables

Read more here and check out our Guided Planner tool, where we’ll point you toward the strategies that might apply to you. The base sales tax rate is 6%, with some counties adding their own surtaxes, which range from 0.5% to 1.5%. The Florida sales tax is 6% for most products, and the proceeds make it the single largest source of tax revenue for the state government. If you earn income in Florida, you know you’ll lose something to taxes. It’s important to understand your state’s income tax and how it will impact your financial future, not least because that knowledge will empower you to take action to reduce your tax bill today.

Combined Marginal Income Tax Rates & Brackets: Florida

- You can choose another state to calculate both state and federal income tax here.

- Urban areas with higher housing prices, like Miami-Dade County, tend to levy higher property taxes.

- TurboTax makes it easy to file your federal taxes and understand how Florida’s unique tax setup impacts you.

- Also, tax bills in Florida have gotten so high that more than 66% of Floridian voters passed a ballot measure aimed at increasing their property tax break.

- Our partners cannot pay us to guarantee favorable reviews of their products or services.

Get $30 off a tax consultation with a licensed CPA or florida income tax EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have. Graduated corporate rates are inequitable—that is, the size of a corporation bears no necessary relation to the income levels of the owners. Florida either does not have income tax or taxes dividend and interest income only. The Simplified Tables do not include the Social Security and Medicare taxes, which are collectively referred to as the FICA taxes.

- Homeowners must apply to receive an additional homestead exemption.

- Instead, all income tax calculations for the year 2024 are based solely on the Federal Income Tax system.

- The federal income tax is a tax that the United States government levies on the annual earnings of individuals, corporations, trusts, and other legal entities.

- Property taxes are a vital component of Florida’s tax system, impacting homeowners significantly.

- For example, if you’re a California resident who worked in Florida in 2024, you must report your Florida earnings on your California (and federal) return.

State Corporate Income Tax Rates and Brackets, 2025

The TPP return is due to the local property appraiser by April 1 and reports all property owned on January 1. Taxpayers https://www.bookstime.com/ requiring a TPP return will be eligible for a $25,000 exemption if the return is filed by the deadline. Once you have your Florida corporate income, you can subtract a $50,000 exemption to arrive at your taxable total. The amount of tax you owe each year is calculated based on your gross income, which includes wages, interest, dividends, and other earnings.

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more. income summary The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

What is the Income Tax?

At Taxfyle, we connect individuals and small businesses with licensed, experienced CPAs or EAs in the US. We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will handle filing taxes for you. Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey. Katelyn has more than 6 years of experience working in tax and finance. She believes knowledge is the key to success and enjoys providing content that educates and informs. Because Florida does not have a personal income tax, military pensions and active-duty pay are not taxed.

Tax Year 2023 Florida Income Tax Brackets

Florida has a 0.71 percent effective property tax rate on owner-occupied housing value. Property tax in Florida is a county tax that’s based on the assessed value of your home. Homes are appraised for market value as of Jan. 1 of each year by county appraisers.

Catégorie: Bookkeeping | Tags:

Amazon’s Project Amelia uses gen AI to boost sellers with personalized business advice

Professional runs $39.99 per month, no matter the amount you sell. The goal is to have the per unit cost be as close to the actual “all in” cost of selling as possible since this directly affects the profitability of the business. If you only have a few products, this is easy to track with a spreadsheet. As you start to stock more SKUs, you may want to migrate to inventory management software to help with this task and keep you on track. What search terms could you add to listings in order to reach more of your intended audience?

COGS and FBA Inventory

It’s best to check with your tax professional or your state’s tax website for more information. Any business owner knows that cash flow is essential, but that can be hard to get a good gauge on, too. It’s challenging to know when to invest in more inventory, pay yourself more, increase your marketing efforts, or save some of that money for the future.

- The efficiency of human reviews improved as well — they were 25% faster than without Neptune.

- Accounting for the cost of inventory when it is sold provides a more accurate view on business profitability.

- What search terms could you add to listings in order to reach more of your intended audience?

- These factors allowed us to complete the experiment in fewer than 5 weeks despite no prior experience with graph databases.

- You also handle all customer service, so it’s important to have a system set up to address inquiries and any issues that arise with your products.

Recommendations for your business

After finding a supplier, you must calculate your cost per unit. Ideally, you have enough of a margin to offer discounts or coupons. You may need to do a viability test on several options before you settle on your first product. A detailed income statement report like this gives you an overview of how much you’re spending in comparison to how much you’re earning.

- For one, if you ever decide to apply for a business loan, you’ll need to provide the creditor with various financial information.

- One way to create great product listings is to use the A+ Content Manager to add videos, comparison charts, and other advanced elements.

- The insight service exposes APIs to query graph data (our data plane) and create, read, update, and delete queries (our control plane).

- When you file your taxes, you’ll need to report your income and expenses, but if they’re not classified correctly, you may be missing out on huge savings or may even incur a penalty.

Relying upon only Amazon’s data for your records

Graphs contain the same data but in a representation that makes it straightforward to trace through many layers of interactions across multiple types of entities. One seller who spoke with the Seattle Times at the conference this week said they voluntarily used FBA and it made deliveries easier for their small business. Adding videos to your listings is easier than ever — and you no longer need to be brand registered to do so. Account health is a very important thing to pay attention to within your Seller Central account.

How to Do Accounting For An Amazon Seller Business

I have submitted my invoice nearly 15 times, but each time it has been rejected for insufficient proof. This ongoing back-and-forth has been incredibly frustrating. If you are listing products via FBM, that means you will be handling the fulfillment of orders yourself. Once you receive an order, you will need https://www.micq.org/page.php?id=246 to fulfill it by purchasing a shipping label and marking the order as shipped — all of which can be done in Seller Central. After entering what your product is, you’ll see a recommended product type. If not, enter more keywords in the “Item Name” section until you see a product type that is accurate.

How to access and change account information in Seller Central

One challenge is how to best visualize graph data for users that are unfamiliar with graphs. Initial feedback from our human specialists indicated a split on whether they found graph visualizations useful. We plan to explore different graph visualization tools and techniques to make insights clearer. The insight service exposes http://www.sat-telik.ru/operator/asiasat.php APIs to query graph data (our data plane) and create, read, update, and delete queries (our control plane). The first step in insight generation is to fetch the relevant graph query from the query repository. Taking inspiration from neptune-export service, we send the graph query to Neptune from an AWS Batch job.

A2X’s COGS feature is designed to help sellers better understand their gross profit margin (sales minus COGS). Accounting for the cost of inventory when it is sold provides a more accurate view on business profitability. One way to create great product listings is to use the A+ Content Manager to add videos, comparison charts, and other advanced elements. Include high-quality lifestyle imagery and background info for your business to vividly share products with customers and show them what your brand is all about. The Professional selling plan is best for sellers who sell more than 40 units per month and need access to advanced reports and APIs. To sell on Launchpad or Handmade, you must have a Professional account.

More than 70% of Amazon sellers generate their first sale in less than 60 days.2

Enter your credit card information and select a billing address if it isn’t already selected when signing up for a Professional account. Not how much revenue you generated in sales, http://stalinism.ru/elektronnaya-biblioteka/akademik-trofim-denisovich-lyisenko.html?start=19 but how much you earned in profit. By adhering to specific processes, this will mitigate the likelihood of missing out on valuable entries which could save you at tax time.

Catégorie: Bookkeeping | Tags:

The Difference Between Bookkeeping and Accounting Bench Accounting

As mentioned, accountancy encompasses a broader scope that includes bookkeeping as one of its essential components. Bookkeeping involves recording, organizing, and maintaining financial transactions and records, such as invoices, receipts, and bank statements. Successful bookkeepers and accountants have a solid understanding of business operations and industry dynamics. They can contextualize financial information within the broader business context, enabling them to provide meaningful insights and recommendations.

Products and Services

They keep track of accounts, reconcile bank statements, and manage payroll, invoicing, and inventory records, among other things. Bookkeeping’s primary purpose is maintaining a clear and comprehensive record of all financial activities, allowing for effective management and analysis of an entity’s financial health. Therefore, professionals in this field ensure that all financial records are accurate, up-to-date, and comply with relevant accounting principles and regulations.

- Because they offer more detailed insights that inform business decisions, you don’t want to hire an accountant to only record income and expenses.

- Set your business up for success with our free small business tax calculator.

- The education required to be competitive in the field is greater, but the payoff down the road can be considerably higher.

- Regularly assess your business expenses to find areas where you can cut costs — such as products or services you no longer use.

- The difference between bookkeeping and accounting isn’t always black and white.

Financial Transparency and Reporting

With these insights, you can spot trends, manage cash flow, and make wise decisions to boost profits. We’ve automated the time-consuming aspects of bookkeeping and tax planning so you can focus on running your business. You also receive live profit and loss reports, cash flow insights, tax estimates, and instant invoices.

Accounting Services

Bookkeepers reconcile bank statements with the company’s financial records to accurately reflect all transactions. This process helps identify any discrepancies and ensures the accuracy of the financial data. They not only prepare tax returns but also provide strategic tax planning advice. Accountants ensure that a business complies with tax laws, financial regulations, and reporting requirements.

- Their meticulous record-keeping and adherence to accounting standards contribute to the overall compliance of the business.

- The skill set of an accountant and a bookkeeper overlap a little, but an accountant has a broader range of skills.

- Technology has also forced both accountants and bookkeepers to be more tech-savvy and adaptable.

- Both fields have stable salaries, but accounting has a better job outlook.

- A small business owner should begin with online bookkeeping and then progress to accounting.

Streamlined Reporting and Compliance

Despite all this, auditing is a completely different process when compared to bookkeeping. The basic difference between the two lies in the tasks involved and the objective of performing the two activities. The magic happens when our intuitive software and real, human support come together. Book a demo today to see what running your business is like with Bench. If you are proficient and comfortable using mathematics and computing figures, plus punctual, organized, and detail-oriented, it is not hard to learn how to be a bookkeeper.

Tax Planning and Compliance

They also reconcile accounts, maintain financial records, and generate basic financial reports. Bookkeepers generate reports like trial balances and general ledgers, which are essential for maintaining accurate financial records. These reports provide a https://www.pinterest.com/gordonmware/make-money-online/ detailed snapshot of the company’s financial transactions but need more in-depth analysis found in accounting reports.

By understanding the differences between these two types of bookkeeping, businesses can choose the method that best suits their needs and resources. Single-entry bookkeeping is a simple system suitable for small businesses and start-ups. Axel has built a distinguished career in project management, focusing on the finance and insurance sectors. He started his career in 2011 in Japan, where he honed his skills at a prominent French Investment Bank, working with both the Finance and Ope… Consider hiring an accountant when financial advice is needed or desired or for compliance reasons.

They must be proficient with accounting software and understand basic accounting principles to record transactions accurately. While formal education can be beneficial, bookkeeping can be done without an advanced degree. CPAs are trained on the latest tax laws and regulations, which can be too complex for a business owner to implement on their own. However, the conventional function of a bookkeeper is to record daily transactions and keep your books organized.

Both bookkeeping and accounting are used interchangeably in the financial world, however, there is a notable difference between bookkeeping and accounting. Bookkeeping is a part of accounting whereas accounting itself is a wider concept. Because bookkeepers tend to work for smaller companies, they may not be paid as much as accountants. Knowing the differences between the two can help people find their niche in the industry and can give guidance to companies on who to hire for their needs. When a bookkeeper wants to leap to being an accountant, they will need to take the CPA exam, plus earn a bachelor’s degree (most of the time), if they do not have one already.

Catégorie: Bookkeeping | Tags:

Debt to Equity DE Ratio: Meaning, Ideal DE Ratio, and How to Calculate it

It suggests that a company relies heavily on borrowing to fund its operations, often due to insufficient internal finances. Essentially, the company is leveraging debt financing because its available capital is inadequate. The ideal debt to equity ratio differs greatly across industries. Capital-intensive sectors (like utilities or manufacturing) often have higher ratios than less asset-heavy industries (like technology). Comparing a company’s ratio to its industry average provides a more accurate assessment of its financial health and risk profile.

If used strategically, debt can provide capital for growth and outperform less aggressive competitors — especially in stable industries. For example, utility companies often carry D/E ratios above 2.0 but still perform well because their services are essential, and they operate under government regulation. They can pass interest costs to consumers, making debt more manageable. For instance, an airline with a D/E ratio of 3.0 may trade at a lower valuation than a tech firm with 0.3, despite similar revenue growth.

FAQs on Debt to Equity Ratio – Meaning, Formula & Easy Examples

To avoid this, we need to check the company’s financial reports carefully. By considering these points and using the d/e ratio formula, we can get a clearer picture of a company’s financial health. Long-term debt, like bonds and mortgages, is due in more than a year. Even with a lower ratio, too much long-term debt can be risky if not managed well. Determining whether a debt-to-equity ratio is high or low can be tricky, as it heavily depends on the industry. A debt to equity ratio of 1 would mean that investors and creditors have an equal stake in the business assets.

Key Ratios Covered in This Post

A high d/e ratio might show a company is at risk of financial trouble. On the other hand, a low d/e ratio could mean the company isn’t using debt well. To figure out a good d/e ratio, we need to check industry standards. As you can see, company A has a high D/E ratio, which implies an aggressive and risky funding style.

- Next, find the shareholders’ equity section on the balance sheet and sum the listed items to find the total shareholders’ equity.

- In the majority of cases, a negative D/E ratio is considered a risky sign, and the company might be at risk of bankruptcy.

- This is because the industry is capital-intensive, requiring a lot of debt financing to run.

- It’s important to note that what constitutes a healthy D/E ratio can vary widely between industries.

What is the debt to equity ratio?

Get instant access to video lessons taught by comparing deferred expenses vs prepaid expenses experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. From Year 1 to Year 5, the D/E ratio increases each year until reaching 1.0x in the final projection period.

Debt-financed growth can increase earnings, and shareholders should expect to benefit if the incremental profit increase exceeds the related rise in debt service costs. The share price may drop, however, if the additional cost of debt financing outweighs the additional income it generates. The cost of debt and a company’s ability to service it can vary with market conditions. Borrowing that seemed prudent at first can prove unprofitable later as a result. For early-stage companies, this ratio is less important than cash flow and growth potential. Both high and low D/E ratios can have implications for a company’s growth and sustainability.

Everything You Need To Master Financial Modeling

Access our advanced insights and resources by joining our membership program, and take the next step toward mastering financial analysis for profitable investments. For instance, companies with moderate D/E ratios, high-quality debt, and strong what happens when a capital expenditure is treated as a revenue expenditure revenue growth may offer the best balance of risk and return. Remember, a healthy debt-to-equity ratio could be your first step towards financial stability and growth. It’s important to note that what constitutes a healthy D/E ratio can vary widely between industries. For instance, capital-intensive industries like manufacturing or utilities might naturally have higher ratios due to the significant investments required in equipment and infrastructure. In contrast, service-oriented sectors or tech companies might exhibit lower ratios.

- Some analysts like to use a modified D/E ratio to calculate the figure using only long-term debt.

- Other financial obligations, like leases, are also part of total debt.

- By understanding the debt to equity formula and what a good D/E ratio is, investors can better judge a company’s financial health and risk.

- We can also increase sales revenue, reduce costs, or enter new markets to generate more cash for debt repayment.

- A company has negative shareholder equity if it has a negative D/E ratio, because its liabilities exceed its assets.

This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). The Smart Investor does not include all companies or all offers available in the marketplace and cannot guarantee that any information provided is complete. Companies with high debt might prioritize loan repayments over dividends, while those with lower debt levels are often in a better position to return capital to shareholders. Additionally, companies in low-interest-rate environments or those with strong pricing power may deliberately use leverage to enhance returns. This article discusses the debt-to-equity ratio, its significance, and how to calculate it. It covers what constitutes a good ratio, defines an ideal debt-to-equity ratio, and explains the implications.

The right D/E ratio varies by industry, but it should not be over 2.0. For example, a D/E ratio of 2 means a company gets two-thirds of its funding from debt and one-third from shareholders. The debt-to-equity ratio (D/E) is calculated by dividing the total debt balance by the total equity balance. The concept of a “good” D/E ratio is subjective and can vary significantly from one industry to another. Therefore, it is essential to align the ratio with the industry averages and the company’s financial strategy.

Upon plugging those figures into our formula, the implied D/E ratio is 2.0x. For startups, the ratio may not be as informative because they often operate at a loss initially. However, as the business matures, the ratio becomes more relevant.

How do I calculate the D/E ratio?

Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2). Additional factors to take into consideration include a company’s access to capital and why they may want to use debt versus equity for financing, such as for tax incentives. A higher ratio suggests that the company uses more borrowed money, which comes with interest and repayment obligations. Conversely, a lower ratio indicates that the company primarily uses equity, which doesn’t require repayment but might dilute ownership.

But, a d/e ratio over 2 might seem bad, yet it depends on the industry. One big mistake is not looking at industry standards when we see a high d/e ratio. For example, a high d/e ratio might not be bad if other companies in the same field have similar numbers. In Q2 of 2022, the US’s d/e ratio was 83.3%, showing a how to calculate sales tax lot of debt across different industries.

The debt to equity ratio is considered a balance sheet ratio because all of the elements are reported on the balance sheet. The debt to equity ratio is a financial, liquidity ratio that compares a company’s total debt to total equity. The debt to equity ratio shows the percentage of company financing that comes from creditors and investors.

When interpreting the D/E ratio, you always need to put it in context by examining the ratios of competitors and assessing a company’s cash flow trends. While a debt to equity ratio below 1 generally signifies lower financial risk, it’s not universally “good.” The ideal ratio varies significantly by industry. A low ratio might indicate a lack of debt financing to fuel expansion; in some cases, a low D/E might limit growth opportunities. In summary, knowing the parts of shareholders’ equity is key to figuring out the debt to equity ratio. By looking at the leverage ratio and d/e ratio, we can understand a company’s financial strength. The debt to equity ratio is calculated by dividing total liabilities by total equity.

Catégorie: Bookkeeping | Tags:

Construction Accounting 101: A Guide for Contractors

Construction business involves very different challenges than other kinds of production. Most of these challenges arise from the fact that construction is project-based, and each project involves unique problems and solutions. Xero adapts to the needs of your industry with customizable reports and tools, including third party apps. We’ll treat your business like it’s our own, by taking advantage ofevery possible legal tax minimization and profitable growth opportunity we can, all the while minimizing risks. © 2024 Website design for accountant contractor accountants designed by Build Your Firm, providers of accounting marketing services.

Accounting software

In simple terms, this report categorizes the services or goods delivered but unpaid (by customers) since an invoice was sent to the customer at a single point in time. Accounts receivable are the legal claims for payment of those unpaid services https://www.bookstime.com/articles/total-manufacturing-cost and goods. To tackle this problem, construction contractors must check with the workers’ local union business manager to find out about requirements for paying union contributions.

Glossary of basic construction accounting terms

Cash accounting is the simplest and most straightforward approach to tracking finances, but it’s also the most limiting. Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the USA. Gusto saves you time on all aspects of your payroll – including calculating employee pay and deductions – thanks to its clever automations. Because I’d really appreciate you sharing this case study with your home-builder and construction industry colleagues, family and friends. You could stick with your current accountant, and potentially give $1Ms more to the IRS and lose even more in profits. Unfortunately, Jim’s accountant became more focused on his own retirement than on helping Jim.

Segmentation of Contracts

- For example, imagine your company estimates a total project income of $1,000,000 and total expenses of $900,000.

- Overall, the profit and loss report helps construction businesses learn where profits are coming from and manage costs efficiently.

- Construction-specific accounting software can help automate many of the repetitive, manual tasks that slow down the close, such as processing invoices, reconciling accounts, and generating reports.

- To streamline communication, accounting teams should establish clear guidelines for when and how project managers should submit cost updates, invoices, and other necessary data.

- Construction businesses that have annual revenues exceeding $25 million over the last three years are required to use the percentage of completion method.

One potential downside of the percentage of completion method is that businesses may incidentally underpay or overpay for taxes depending on how accurately they estimate costs. Construction businesses that have annual revenues exceeding $25 million over the last three years are required to use the percentage https://www.facebook.com/BooksTimeInc/ of completion method. These larger businesses also include general overhead costs within each project, which has the advantage of providing clear insight into exactly how profitable each job is. One potential downside of the accrual method is that businesses can pay income tax on unrealized profit since the accounting system can record revenues that have not yet been received.

- In fact, accurate bookkeeping helps the business make long-term predictions.

- When done properly, job costing helps construction managers and accountants predict costs and assess project budgets more precisely.

- The two most common accounting methods are cash-basis accounting and accrual-basis accounting.

- The company must calculate labor hours and materials spent during each billing cycle to determine how much to bill the customer.

- Unfortunately, Jim’s accountant became more focused on his own retirement than on helping Jim.

- Properly managing change orders ensures that all changes are documented, approved, and reflected in the project’s budget and timeline, preventing scope creep and cost overruns.

Accounting Analyst

Furthermore, like a general ledger accountant, it is essential to monitor the progress of accounting processes, all while implementing the company’s policies and regulations. A certified public accountant (CPA) acts as an advisor to small businesses and chief financial officers to Fortune 500 companies. They aid businesses and individuals to plan and achieve their financial goals.

Catégorie: Bookkeeping | Tags:

Construction Receipt Templates in Word FREE Download

Use this template to help ensure that you, your construction invoice team members, and your subcontractors are paid in a timely manner. A construction receipt template is used by a business engaged in construction services to present a well-detailed receipt to their clients. In the business receipt template, it provides a list of all construction services provided by the construction workers including the terms of payment and conditions of the business. A contractor Receipt Templates will be necessary as a contractual legal agreement for a requested project asked by a customer or company. Using a construction receipt template is much easier than starting from scratch. You can go in on construction receipt templates and edit sections that need to be changed.

Unit Price Contract Invoice Template

Customize your invoice with any miscellaneous charges and contact information, should there be any questions concerning the invoice. Enter the details you want to include on future invoices, and save this template as your standard construction invoice. Every payment given to a construction company corresponds to a work completed. To give both the service provider and its client a proof of the payment, receipt document should be made and kept.

Keynote Templates

A contractor has to issue and it records details of the parties involved in the service contract, project or services details, unit price, total price, signature, etc. Unfortunately, payment disputes happen in construction, and contractors need to utilize mechanics liens to level the playing field. With an organized, clean, comprehensive construction invoice template, they’ll have surefire documentation to bring to court. Equipment rentals, parking fees, and other miscellaneous job expenses usually won’t fall under materials, so the “other” section is where the construction invoice template should list them. A successful construction invoice provides a client with a detailed breakdown of materials, labor, and miscellaneous costs.

- When you are issuing a receipt, remember to print two copies, one for the customer and one for your company.

- Instead of reinventing the wheel, use a time-tested construction receipt template from Invoice2go.

- Users and contractors can send in a batch of their receipts through a pre-paid envelope called the Magic Envelope.

- The other occasion is if you want to fill out or issue a receipt digitally, in which case you’ll need to fill in the relevant fields via text editor.

- If you’re looking for the fastest, most convenient way for your customers to pay you, you’ll need to know how to accept payments online.

Construction Payment Receipt Excel Free Download

We’ve compiled the most useful construction invoice templates for construction companies, project managers (PMs), general contractors (GCs), subcontractors, and independent contractors, as well as helpful tips. By starting with a construction receipt template, you’ll already have suitable stylistic choices and a good basic framework for your custom construction receipt. In the best-case scenario, you might need to add nothing more than your company information and a logo.

Streamlines accounts receivable

- A premade blank invoice template can help busy roofers who have little time to spend on creating invoices.

- There are a number of different ways that a receipt can be formatted, but the most common ones are those that have the company information at the top of the receipt.

- A construction receipt is a document that serves as proof of payment for construction services or materials.

- Use our receipt tracker + receipt scanner app (iPhone, iPad , and Android) to snap a picture while on the go—auto-import receipts from Gmail.

- The searchable and organized data from Shoeboxed makes the audit process easy, so all documents and information are at your fingertips.

- It is important to specify these details so that whenever there are conflicts and clarifications by the clients, the company can quickly review it.

Here is a complete guideline with all you need to know about construction receipts and their management. The construction receipt in the word format can be used to keep an account of the materials used https://www.bookstime.com/ in the construction. Tax related information like receipt number is also present in the sample.

- Every payment given to a construction company corresponds to a work completed.

- Use this universal construction invoice template to bill clients for the work you’ve completed, regardless of the type of construction project.

- Make your receipt different from others by using your unique patterns, color placement, and other elements.

- As a contractor or subcontractor, you need a detailed template to account for additional or emergency work that may be required for a project.

- Customize your invoice with any miscellaneous charges and contact information, should there be any questions concerning the invoice.

- These are the essential elements that make up an effective construction receipt.

- Whether it’s one bill at the end of the job or several smaller bills throughout its lifetime, these payments help the business keep the lights on, grow, and take on more jobs.

What to Add in a Construction Receipt Document?

- The template also provides space for you to detail any extra work for accurate, up-to-date invoicing.

- Aside from that, the number of units and total costs are required to be instilled as well.

- If the payer is a representative of a certain organization, then they have the choice to let you input their organization’s details instead.

- By using a construction receipt template, you can potentially sidestep all of these concerns and immediately have a suitable receipt design available.

- Prices for products, services, and labor should be included on each line of the invoice and should all be listed separately.

- Basic InformationStart with basic information such as the contractor or business’s name, address, and contact information.

- The receipt just needs to have the vital parts that are needed in a proof of transaction document, and could be customized in any way.

For even more invoices, retained earnings balance sheet check out FreshBooks’ invoice template gallery, plus the industry-specific templates available below. In almost all cases, the costs involved with putting up a new building or structure are grossly underestimated. That’s why you need to have an accurate yet flexible parts and labor budget. Overbilling occurs when a contractor bills for contracted labor and materials prior to that work actually being completed.

Catégorie: Bookkeeping | Tags:

Service commercial : 01 80 88 43 02

Service commercial : 01 80 88 43 02